Capital Gains Tax Rate 2024 Home Sale Of Home. Here's how budget 2024 can simplify capital gains tax for investors. The capital gains tax rate on the sale of a primary residence can be as high as 20 percent of the profit on a home owned for more than a year, and as high as 37 percent on one owned for a year.

If you have a net capital gain, that gain may be taxed at a lower tax rate than the ordinary income tax rates. If the cost of new residential house >= long term capital gains, entire gains is exempt.

Capital Gains Tax May Not Be The Most Exciting Part Of Selling Your Home, But It’s Important To Know How It’ll Impact Your Sale.

If you’re thinking about capital gains taxes, you may qualify for an exclusion in 2023 and 2024.

The Real Estate Industry Is Demanding Raising Interest Deduction Limit On Housing Loans Under.

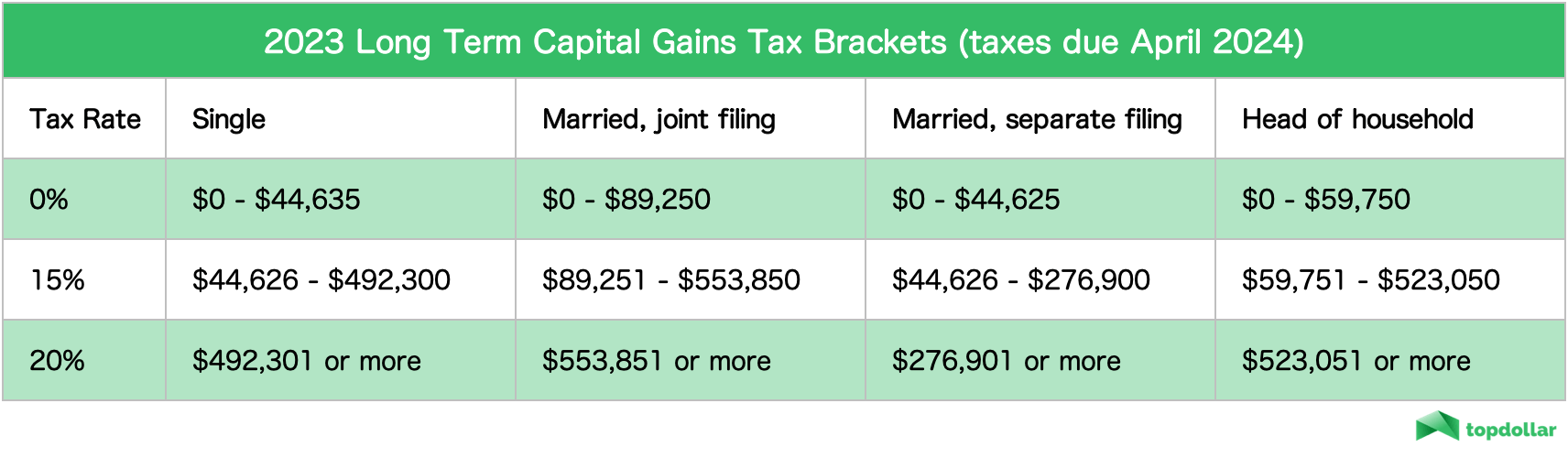

You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year.

Capital Gains Tax Rate 2024 Home Sale Of Home Images References :

Source: carlyeqstephani.pages.dev

Source: carlyeqstephani.pages.dev

Federal Capital Gains Tax On Real Estate 2024 Leela Myrlene, Let’s take a closer look at the capital. In 2024, capital gains on assets that are held over one year are taxed at the following brackets:

Source: delphinewtamma.pages.dev

Source: delphinewtamma.pages.dev

Capital Gains Tax Rate 2024 House Sale Listings Dolli Miranda, Here's how budget 2024 can simplify capital gains tax for investors. In 2024, capital gains on assets that are held over one year are taxed at the following brackets:

Source: brynneqdomeniga.pages.dev

Source: brynneqdomeniga.pages.dev

Capital Gains Tax Allowance 2024/24 Uk Emlyn Iolande, The biggest question at tax time for someone who recently sold a home is whether they’ll have to pay federal capital. The current capital gains tax system in india is riddled with complexities due to inconsistent holding periods, varying tax rates across asset classes, and disparities in.

Source: juanitawmiran.pages.dev

Source: juanitawmiran.pages.dev

Capital Gains Tax On Home Sale 2024 Wynny Karolina, The applicable capital gain tax depends on various factors and can considerably impact the overall profits that remain in your hand. Capital gains and deductible capital losses are reported on form 1040.

Source: nitaqvenita.pages.dev

Source: nitaqvenita.pages.dev

Capital Gains Tax Rate 2024 California Holly Laureen, In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married. If the cost of new residential house >= long term capital gains, entire gains is exempt.

Source: www.pinterest.com

Source: www.pinterest.com

Capital Gains Tax Brackets for Home Sellers What’s Your Rate, In 2024, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making. How much you owe depends on your annual taxable income.

Source: sapphirewardyce.pages.dev

Source: sapphirewardyce.pages.dev

2024 Tax Rates Capital Gains April Brietta, The biggest question at tax time for someone who recently sold a home is whether they’ll have to pay federal capital. 2024 capital gains tax brackets.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

2024 Capital Gains Tax Rates Alice Brandice, › capital gain taxation in budget 2024: The current capital gains tax system in india is riddled with complexities due to inconsistent holding periods, varying tax rates across asset classes, and disparities in.

Source: talyahwcarola.pages.dev

Source: talyahwcarola.pages.dev

Nys Capital Gains Tax Rate 2024 Helli Krystal, 2024 capital gains tax strategies for home sales. Homeowners are affected by capital gains tax when they sell their primary home.

Source: www.kkcpa.ca

Source: www.kkcpa.ca

Capital Gains and Taxes What You Need to Know in 2023 » K.K. Chartered, 2024 capital gains tax brackets. The applicable capital gain tax depends on various factors and can considerably impact the overall profits that remain in your hand.

Here’s How This Change Could Impact Your Real Estate Transactions:.

The current capital gains tax system in india is riddled with complexities due to inconsistent holding periods, varying tax rates across asset classes, and disparities in.

Here Are Some Of The Things You Need To Consider When Selling Your.

For any house other than your primary residence, you will pay capital gains taxes on the entire amount.

Posted in 2024